🚀 Become a Verified Author on Trending Hub24

✍️ Author Account Available @ $60 / Month | +91 7355993756

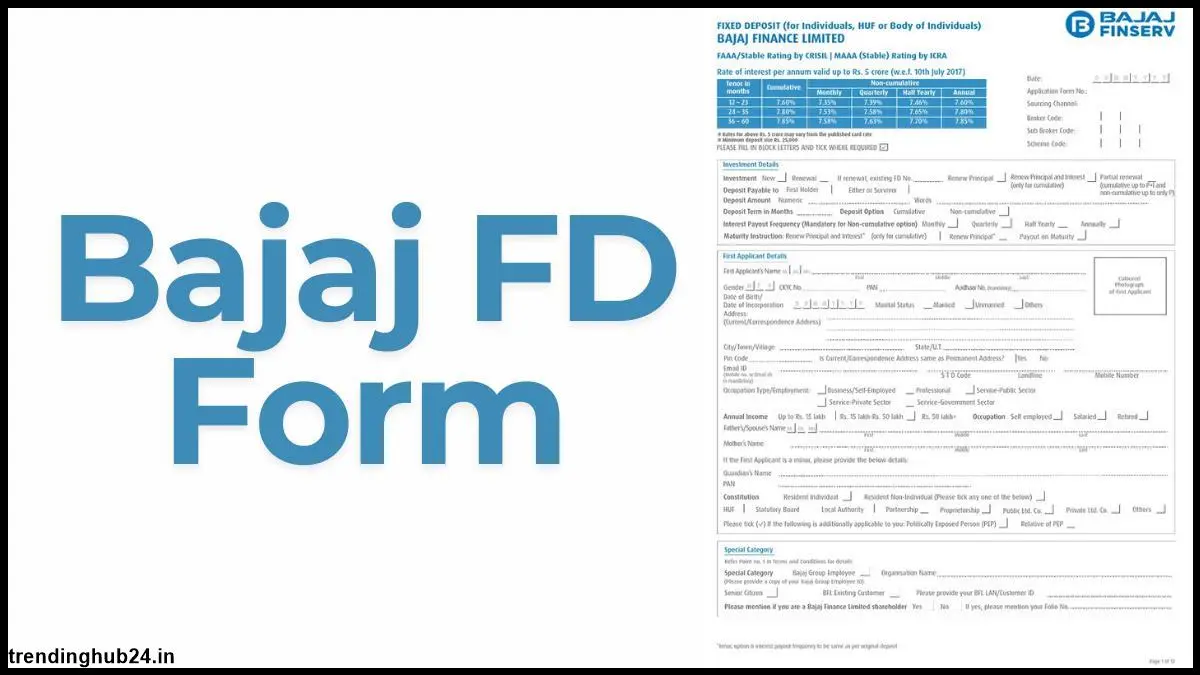

Bajaj Finance FD A Smart Option for Secure Investments

Bajaj Finance FD remains a top choice due to its competitive interest rates, security, flexible tenures, and easy application process.

Table of Contents

Nowadays, many investors face some challenges to make their future secure and smooth in finance. Stock markets, bonds, and real estate investments require capital and have some risks. If you prioritize safety, you need to find a secure financial vehicle. For this purpose, Bajaj Finance Fixed Deposit comes in. It provides affordable and attractive interest rates and security. Bajaj Finance FD is perfect for people looking for dependable returns without risky investments.

Investors are searching for various ways to increase their financial growth without getting into risks. Bajaj Finance FD provides a perfect investment option and combines high interest rates with capital preservation. If you want to protect your savings and also earn better returns, Bajaj Finance FD is the perfect and popular choice for your needs. You can access the Bajaj FD form easily for hassle-free investment. Here you can see why it is a smart option:

Why Bajaj Finance FD is a Smart Choice

1. Competitive Interest Rates

Bajaj Finance Fixed Deposit provides 8.40% interest for existing and regular investors and 8.65% for senior citizens. These rates are higher than many traditional banks which makes Bajaj Finance FD an attractive one for investors looking for stable returns.

Additionally, the Fixed Deposit provides special tenure options such as 42 months and also provides better returns through their digital platform which ensures flexibility and better financial rewards.

2. Security

One of the main problems for the investor is the safety issue of their capital. Bajaj Finance FD has gained AAA ratings. It provides security to investors.

This credit rating assures Bajaj Finance has the ability to meet its financial obligations which makes the FD a low-risk investment during the time of insecurity. The Bajaj Finance FD form can be accessed smoothly and easily to start investing in a low-risk option for better returns.

3. Flexible Tenure Options

Investors can choose from various tenures in Bajaj Finance FD. The flexibility in tenure ensures you can personalize your investment to meet financial goals. Special tenures such as 18, 22, and 42 months provide higher returns. With the Bajaj Finance Ltd FD form, you can explore these tenures and maximize your returns easily.

It allows investors to find a plan that suits their needs. If you are planning for long-term growth, Bajaj Finance FD provides the flexibility you need.

4. Easy Application Process

Convenience is the most important thing when making a decision for investment. In 2024, the FD application process will be available online and offline. You can apply for the FD through Bajaj Finance’s user-friendly digital platform.

This platform allows investors to track their investments, renew their FDs, and make withdrawals easily with some paperwork. If you prefer the traditional route, offline application options are available in Bajaj Finance.

5. Multiple Interest Payout

Bajaj Finance FD provides various interest payout options. It allows investors to choose from monthly or annual payment options. This is beneficial for senior citizens or anyone looking for regular income from their investments. Bajaj Finance FD can be customized to suit your financial situation.

6. Low Minimum Investment

Looking to start a small business? Bajaj Finance FD provides an affordable minimum investment amount which makes it accessible to various investors. This feature makes it the perfect one for individuals. With the Bajaj FD form, investors with limited capital can benefit from the high returns and security that come with Bajaj Finance Fixed Deposits.

7. Tax Benefits

In Bajaj Finance FD, the security and high returns make it the best choice for risk-averse investors. Additionally, you can explore other tax-saving options in combination with your FD investment to create a perfect financial plan.

Interest Rates for Bajaj Finance FD in 2024

Tenure | Regular Investor's Interest Rate | Senior Citizen's Interest Rate |

12 | 7.40% | 7.65% |

15 | 7.50% | 7.77% |

18 | 7.80% | 8.05% |

22 | 7.90% | 8.15% |

24 | 7.80% | 8.20% |

Why It Is Best Over Other Investment Options

Mutual funds, bonds, and real estate are the popular investment options. But Bajaj Finance FD provides some better advantages for investors.

- Mutual Funds

Mutual funds can get better returns, but they are also subject to market volatility. Bajaj Finance FD provides guaranteed returns which makes it a safer choice.

- Bonds

Although bonds provide steady returns, they are associated with lower interest rates. Bajaj Finance FD provides higher interest rates and has a AAA (Stable) rating which ensures safety.

- Real Estate

Real estate investments require capital and have risks. Bajaj Finance FD provides easy liquidity options and it requires less initial investment.

Final Words

For conservative investors in 2024, Bajaj Finance FD remains a top choice due to its competitive interest rates, security, flexible tenures, and easy application process. The Bajaj FD form allows investors to start quickly which ensures their savings grow securely. Its attractive interest rates ensure your savings grow securely. If you are looking for an investment that provides safety, Bajaj Finance FD is the perfect option for you.