🚀 Become a Verified Author on Trending Hub24

✍️ Author Account Available @ $60 / Month | +91 7355993756

Jeevan Saral Plan 165 Loyalty Addition Calculation

Jeevan Saral Plan 165 maturity calculator with loyalty addition provides insights into the policy's returns,helping policyholder plan their finances better

Table of Contents

The Ultimate Guide for LIC Jeevan Saral Plan:

LIC Jeevan Saral is an insurance policy offered by Indian Life Insurance Corporation. It combines the top benefits of old life insurance with an adaptable savings feature. This is designed to provide financial security and maturity benefits and this plan is suited to individuals seeking both protection and returns. This plan is no longer available for new buyers. However, existing policyholders continue to enjoy its inclusive features. This post explains the LIC Jeevan Saral plan clearly in detail:

Understand LIC Jeevan Saral Plan

LIC Jeevan Saral is a financing policy. This focuses on offering financial protection to the family of the policyholder with unexpected death. This also offers savings benefits in the form of maturity returns. Policyholders had the flexibility to customize the policy to match their specific requirements. This makes it an attractive choice for many policyholders.

If the policyholder unexpectedly dies during the policy term, the plan provides death benefits. This ensures financial security for the nominee. If survived until the end of the policy term, the policyholder receives maturity benefits. This dual-purpose approach made LIC Jeevan Saral a sought-after plan during its availability.

Key Features of LIC Jeevan Saral

The plan offers several attractive features, ensuring its appeal to a wide range of customers:

- Flexible-Premium Payment Options

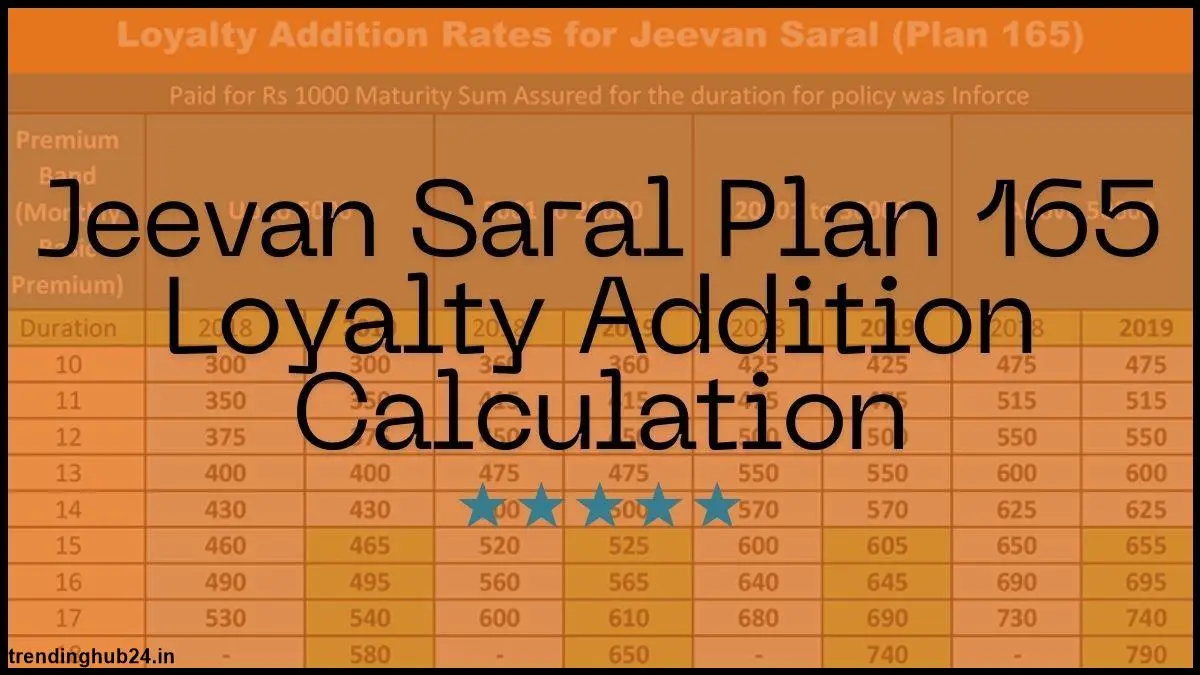

Policyholders had the flexibility to choose from multiple premium payment methods. This includes monthly, quarterly or annual, based on their convenience. The Jeevan Saral Plan 165 loyalty addition calculation is based on the policy's performance, with loyalty additions being payable from the 10th year onwards, depending on the corporation's profit experience.

- Loyalty Additions

This plan was profit-linked, which means it contributed to LIC's overall profits. Eligible policyholders received loyalty additions as terminal bonuses. These were able to be paid after completing 10 years of the policy term and were added to the maturity or death benefits.

- Customizable Riders

The plan provided options for enhancing coverage through additional riders. This includes the Term Rider and the Accidental Death and Disability Benefit Rider, providing enhanced security.

Benefits

Below detailed are the major benefits provided by the LIC Jeevan Saral Policy:

- Death Benefit

If the policyholder unexpectedly dies death during the policy term, the nominee receives a larger sum amount. This includes 250 times the monthly premium, loyalty additions, and the return of premiums that were paid.

- Maturity Benefit

If the policyholder survives the policy term, they receive a lump sum payment that comprises the maturity sum assured and also loyalty additions. This ensures financial security for future needs. The Jeevan Saral Plan 165 maturity calculator with loyalty addition helps policyholders calculate their maturity benefit. This includes the loyalty additions based on the policy's performance, which are outstanding from the 10th year.

- Surrender Value

The plan allowed policyholders to surrender their policy if they needed funds before the policy term ended. Both ensure and special surrender values were given. This is based on the policy periods and the premiums paid.

- Grace Period

To ensure policy continuity, a grace period of 30 days was provided for annual and semi-annual premiums. For monthly payments, the grace period was 15 days.

- Free-Look Period

Buyers had 15 days to review their policy terms and conditions (30 days for online purchases). If unsatisfied, they could cancel the policy during this period and receive a refund after deductions for administrative charges.

Requirements for Eligibility

Policyholders had to meet the following requirements to register in the LIC Jeevan Saral plan:

- Entry Age: The minimum age was 35 years. The maximum maturity age was 60 years.

- Policy Term: Ranges from the ages of 10 to 35 years.

- Premiums: Monthly premiums start at Rs. 250 for younger individuals. This increases based on the policyholder's age.

How the Plan Works

LIC Jeevan Saral operates on a flexible structure. This enables policyholders to choose their desired premium rates. Based on the premium, the sum assured will be assessed. The maturity benefit, like loyalty additions, is paid at the end of the policy term if the policyholder is alive. In the case of an unexpected death, the death perk and applicable bonuses will be paid to the nominee.

The plan also provides surrender options. This enables policyholders to retrieve a portion of their invested premiums based on the policy's duration.

Loyalty Additions and Maturity Calculator

One of the plan's key highlights is its loyalty additions. These will be included in the maturity or even the death perks. These additions depend on LIC's overall profits and are not ensured. Policyholders can use LIC's Jeevan Saral Maturity Calculator to calculate the maturity amount by giving details. This includes age, policy term, and premium amount.

Why Consider LIC Jeevan Saral?

LIC Jeevan Saral remains a valued product for existing policyholders. This is due to its flexibility, financial security, and adaptable benefits. It provides security for families in case of unforeseen events, as well as offering attractive returns upon maturity.

Wrapping Up

LIC Jeevan Saral is an adaptable insurance plan that successfully combines protection and savings. Its unique features, like loyalty additions and customizable options, made it a great choice for individuals seeking inclusive coverage. The Jeevan Saral Plan 165 maturity calculator with loyalty addition provides insights into the policy's returns, helping policyholders plan their finances better. Policyholders can maximize their investment and ensure financial security for themselves and their loved ones. This is by understanding the plan's features and benefits.